Episode 10

Episode 10

· 19:21

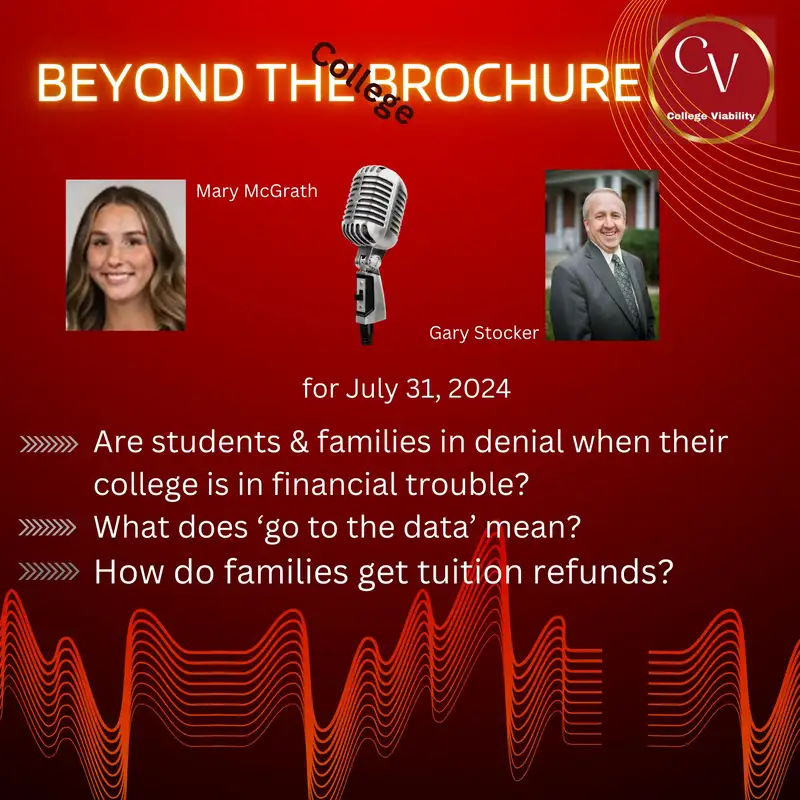

Mary McGrath (00:00)

Hello and welcome to the Beyond the College Brochure podcast where we provide you information and guidance about college financials and decisions. My name is Mary McGrath and I'm a rising senior at Linwood University. And my cohost today is Gary Stocker, who is also the founder of College Viability.

Gary, welcome to the podcast.

Gary (00:17)

Mary, always good to get together on Wednesdays or Fridays, whatever happens to work out for both of us. And what kind of questions do you have for me today that students, college students and their families might be interested in listening to?

Mary McGrath (00:30)

Yeah, so right off the bat, think it's good to look at it from obviously more of a student and family perspective since I would assume that's where most of our listeners are kind of coming from in their situation. So would you say that students and parents are possibly in denial when they have concerns about their college's financial

Gary (00:48)

Yeah, interesting, interesting question. Probably, probably in denial. And here's why I say that, Mary. You went through this a few years ago. You went to a lot of work with yourself and your family and probably others to decide on what college would work out best for you. And I understand, and all of our regular listeners know you're a college athlete. All that work that goes into it is very difficult to say, you know what? All that work we went in that went into choosing college, whatever, was for naught because now we're

comfortable with our choice, but let's just ignore it. It'll be OK. And certainly in many cases, it probably will be OK or close enough to OK. But like you and I've talked before, Mary, it's really the first step. And this is new. The culture of our society has been just like you went through it a few years ago and I went through it long, long time ago. As we look at the college.

majors, we go to the college campus, maybe we talk with some faculty, we look at the residence halls, we maybe sample the food, we look at their tuition rates, and we make decisions based on that. And there was nothing wrong with that over the last many, many decades, but now we're in an era where, as you and I have spoken, there are too many colleges and too many college seats and not enough students like yourself and others to fill those seats. So I recommend to anybody who will listen to

that the first step in putting that college consideration, college selection list together is to look at the college's finances. And again, one of the reasons we do these podcasts is to share that we have the 2024 College Viability app. We have a version for parents and students and parents for private colleges and one for public colleges as well. And Mary, it's $29, 30 bucks to make sure that the colleges you're considering

have good enrollment increases, have tuition and fee revenues decent, have for crying out a graduation rate that's about 50 % or more. So if you're listening to this and you're starting the list or you've made the decision on a college, know, go to the site that we'll have in the show notes that Mary will put in the show notes for you and grab the college viability app. Just make sure you're comfortable with the colleges you've chosen.

Mary McGrath (03:07)

And as some of our listeners may know, you're also the host of another podcast called This Week in College Viability, where you discuss, it's a little bit different than ours, but you discuss similar topics. And on that podcast, you regularly say, let's go into the data. So what do you mean by that when you say

Gary (03:22)

Yeah, every Monday about one o 'clock each afternoon, I podcast a recording of This Week in College Viability. It's really the Gary Stocker news and commentary, if you will, on higher education. And it is a lot different than what you and I do, Mary, because you and I focus on students and their families. And the This Week podcast is for really all higher education professionals, not necessarily for students and their families, although they're welcome to look at it. And colleges, Mary, spin stuff.

they spin a bad situation or average situation into look like it's fabulous. And so one of the things that I do on this week is I use data to refute some of these silly and even ridiculous claims that colleges make. So when I say, let's go to the data, and I have some kind of recognition for using that phrase, is actually use the college viability app and the data that colleges themselves, Mary, have submitted.

to the federal government to say, hey, don't say you're doing really well when your enrollment is down 40 % over the last eight years, or you can't even graduate half your students. So I go to the data just to refute objectively when colleges try to spin stuff. Now, Mary, there's not enough hours in the day for me to respond and refute every college's spin stuff. And there's nothing wrong with spin.

You and I do it, everybody does it. We spend it in our personal lives, in our business lives, and all those kinds of things. But the going to the data part is just my humble effort to let the industry recognize, and even non -industry participants, to recognize that colleges, especially private colleges, especially smaller private colleges, and especially smaller private colleges in rural areas, they're not in good shape in general.

and the consumers that would use their service, their college education, their college degrees, needs to be aware of that. I'm simply pointing out the fallacies that colleges are trying to spin into facts when indeed they're not facts at all. They're just spin.

Mary McGrath (05:34)

And when we look at the college admissions process, obviously there's a lot of different factors that go into that, whether it be resumes or scores on tests like the ACT and SAT and everything like that. coming from a student perspective, I know I can speak for myself when I say college essays was one of the things that I was probably most nervous about and also had the most questions about. So would you say that college admissions essays are a big

Gary (05:58)

Well, Mary, can probably tell you you generated unnecessary ulcers when you did your college applications a few years ago. it's really, except for the top 30, top 50 colleges that have a lot more applicants than there are seats available. The application means, I'm sorry, the essay means nothing. For Harvard, for Yale, for Ohio State, for the University of Illinois, University of Michigan, University of Texas, USC.

Ivy colleges, yes, it's a big deal. And most folks in that search for those top 30, top 50 colleges, they pay somebody, and sometimes a lot of money, to help them write those essays. But for the thousands of other public and private colleges, most of whom still have that essay requirement, it is an unnecessary hoop. I can even offer, Mary, for the listeners, that if a college is not one of those top 50 that I just referenced,

is asking for an essay, go somewhere else. They don't need your essay. They're not going to use it. And here's why. You know, I've talked about this before. Colleges need you, need students a lot more than students need any individual college. And so colleges don't use those essays. In rare cases do they use those to make admissions decisions unless it's one of those top, we're called selective colleges. And outside of that,

If they have a requirement, find a way to make it easy, but please don't generate ulcers on an essay. Use your favorite AI tool. Let it help you at start, provide you some guidance on what the essay should look like, and then just make minor modifications just to fulfill the ridiculous requirement that too many colleges still have for those essays.

Mary McGrath (07:51)

And another hot topic that we see in the news about college admissions in general, we talked about it a bit in the last podcast actually is tuition and just the different tuition pricing and things like that. So is it possible for students and families to get a refund on their tuition, whether it be because of a college closure or just they need some sort of.

Gary (08:09)

Yeah, yeah, really good question. And context matters here. If you're going to whatever University A and you don't like the faculty member, or you don't like the course, or you don't like the syllabus, or you don't like the building, I don't know that it's not going to be likely that you can get a tuition refund. It's just not. Maybe you can in isolated circumstances. But you mentioned in your question that for closing colleges, and indeed, if

Despite our best efforts, Mary, you've chosen a college that closes. There are protection mechanisms, and I've seen two. One is most colleges, in all fairness, that close, they do refund tuition for the upcoming term. So for example, if you're getting ready to start at University One this fall and they close and you've already paid tuition or deposits, they'll refund it. In almost all cases, there are rare exceptions to

And the other one is on the loans. If you've taken out sizable loans or any loans to go to college from the federal government, the loans have to be from the federal government and your college closes, there are ways to get that loan removed from your account and not have to pay that back. I'm not completely familiar with details, but I know the opportunity does exist to get refunds on tuition for colleges that close.

Mary McGrath (09:32)

And on this podcast, we obviously talk about a lot of different types of universities, both public and private. But one term that kind of does come up a lot, and it might not be super obvious to some listeners about what that actually means, is when a school defines themselves as a liberal arts institution. So what would you say that that means?

Gary (09:52)

You know, the use of the term liberal arts college, liberal arts institution is kind of like the old saying, America's hot dogs. Chevrolet's an apple pie. Now you're too young, you may not remember that. But back in the day, hot dog, Chevrolet, apple pie was Americana. And colleges tend to use the phrase liberal arts to describe a perfect world where they teach you to be the perfectly well -rounded, perfectly well -rounded Mary McGrath you can possibly be. Nothing wrong with the concept. Liberal arts colleges.

tend to focus on a broader approach, not just a specific discipline. For example, your majors, the two majors you have, they're finite. They're in certain areas that you're focusing on, finance and marketing. A liberal arts college will include a lot of focus on arts and sciences, humanities and social sciences. And the argument they make, and it's a logical argument, is it makes you a more well -rounded person. It helps you think better, I guess, is kind of a crude way to say it.

What's happened though, and again, nothing wrong with the liberal arts model, the liberal arts concept, but the market, the students going to college, Mary, are saying, you know what? I want to be a CFO. I'm going to do finance. I want to be a CPA. I want to be an accountant. I want to be a physician. I'm going to take all science and math classes. I want to be a nurse. I'm going to take science classes. It's really the focus has turned from that broad spectrum education.

And it really was in place when I went to college many, many, many years ago. And it's kind of evolved away from that. So it's now a focus on what degree, what major will increase my odds of a significant financial salaries, financial, substantial income in my years after college. The liberal arts model be damned to be crude because that doesn't help me raise my earning potential. Now.

The liberal arts folks listening to this were probably throwing stuff at their computer screen right now because they make the case, and logically, that broad spectrum thinking is valuable to every business, to every industry, to every human being. And no question, the ability to think across broad spectrums is a great idea. But the market is the market. the market always, at end of the day, the market always dictates

sodas we're going to buy, what coffee we're going to buy, what computers we're going to buy. And that's what's happening with colleges. Folks want those STEM, those science, technology, engineering and math classes, because that's where they think the compensation is. And that's why that liberal arts model is becoming less and less of a focus.

Mary McGrath (12:34)

And as we know, there's a lot of different resources out there for students and families to help guide them in the college decision making process. Obviously, the best and my totally unbiased opinion is that the Twenty Twenty Four Private College Viability app is the best one. But anyway, I digress. So we've come across one. It's called TuitionFit .org. Have you heard of this? And do you kind of know what that website entails?

Gary (12:46)

Ha ha ha ha ha ha

Yeah, absolutely. Mark Salisbury is a guy who founded that. He and I touch base regularly. And TuitionFit is the first and probably the most established web page, website that you can go to. And I'm going say that slowly. TuitionFit, one word, dot org. TuitionFit dot org. Where you can go to submit your basic financial scenario and your academic background.

and the website will then give you comparable offers from other colleges. For example, you're looking at going to College One and you submit your data, their financial and academic data to TuitionFit, and they will show you what kind of scholarship offers, discount offers, that colleges two, three, four, five, all the way to 10, whatever, got for the similar financial and academic profile that you and your family present.

So now all of a sudden, Mark Salisbury and tuitionfit .org, Mary, that were your family and you weren't a star college athlete, you would be able to go to college five and say, know, college one gave me an offer of $45 ,000 in scholarships and discounts. You're only at 40 ,000. I need you to go up to at least the same at the other college.

If you didn't have that kind of tool, you're really forced to having a conversation with the college that says, hey, I need a discount. And they're going say, well, we gave you a discount. so tuitionfit .org gives you that objective. Go to the data, that data leverage. Say, hey, I've cut an offer in my hand from this college that is $5 ,000, $10 ,000 better than your offer. Match it or I'm going to go somewhere else.

Mary McGrath (14:36)

And another term that our listeners may or may not be familiar with is endowment. Can you kind of just explain what that

Gary (14:43)

Yeah, sure. Good question. Endowment is really gifts. It's financial gifts. And they typically come from alumni of a college, sometimes students, sometimes family members of students, and sometimes just general community members who want to help uplift a college. There are two basic types of endowments. The first is called a restricted endowment. And say, I want to give a million dollars to your university, and it can only be for nursing.

And we're going to call it the Mary McGrath Nursing Scholarship. And that college is going to use that million dollar donation that are going to use the earnings off that, not the principal of the million, but the earnings off that million to award scholarships to future nursing students. That's all that million dollars and its earnings can be used for is scholarships for nursing students. And they can be for business and finance and engineering and anything. Foreign languages, arts, whatever. It's a restricted, dedicated, if you will.

is a synonym for restricted fund and endowment. The unrestricted one is when I give a million dollars to a university and say, hey, use it for whatever you want. It's called, as you might guess, unrestricted. And so the colleges that have a larger unrestricted endowment are better off than colleges that have a restricted endowment because those with that unrestricted endowment, and I'm trying not to use those words too many times, has more flexibility.

And what I find in the research that I do on the financials of colleges is most, yeah, I think that's fair, most colleges have a lot more restricted endowments than they do unrestricted endowments. And that's concern, especially for those colleges, and we've talked about in those colleges and financial trouble, while they can use restricted endowment, it's a cumbersome and public process that they don't really wanna go through. And really, I think, I've talked about this a while back.

When I, the work that I do, I use a minimum endowment threshold of 50 million, five zero million. I make the case that if your college know how big it is or how long it's been around, and most have been around decades, if not centuries, if you haven't raised 50 million, five zero million for your endowment, it doesn't really matter whether it's unrestricted or restricted for this example, then you don't have either the systems or processes, Mary, to raise those funds.

or your alums, your community, your families don't see the value in making their charitable gifts to your college. Neither of those is a good thing. So that's why we look at endowments. And that's why when I talk about colleges, when I go to the data, like we talked about earlier, I go and look at that endowment. And if it's 15 million, 20 million, 30 million, that concerns me.

because that college has exhibited a historical capacity to raise the funds needed to maintain a large endowment and able to use the earnings that come from that endowment to keep the lights on and to meet payroll and many other expenses.

Mary McGrath (17:45)

And do you have any specific examples of different podcasts or videos that students and families can use to help guide them in the college decision making process?

Gary (17:56)

You know, I see so many of those kind of sites and a lot of them have really good content, Mary. I don't know that I want to share any in particular. The best bet that I would give listeners is to use that term. College guidance counselors, college counselors, help me find a good college, tool, search words like that and just assess them yourselves because those that come at the top of the search.

are probably going to be the ones that are most viable and can provide value. Do your own searches. There are a lot of free tools out there that you can use on the top 10 tips in choosing a college. And all I would suggest is when you're doing that process, that especially if you're looking at private colleges, that you use the College Viability app to make sure your college is financially healthy and even financially viable.

Mary McGrath (18:54)

And on that note, it'll be a wrap for myself and for Dr. Gary Stocker. Thank you so much for joining us today on the Beyond the College Brochure podcast. We provide guidance on college decisions, financials, and much more. If you have any questions or concerns about the financial health of colleges you're looking at, you can send them to marym at collegeviability .com. Thank you again for making time to join us today. Hope to see you next

Listen to Beyond the (College) Brochure using one of many popular podcasting apps or directories.